Is overtime still taxed? When does “no tax on tips” start? With so much buzz around new federal tax changes, employers are left sorting out what’s accurate and what directly affects payroll.

You may have heard about a “No Tax on Overtime Act of 2025” or seen headlines suggesting that tipped income won’t be taxed anymore. The truth is more nuanced.

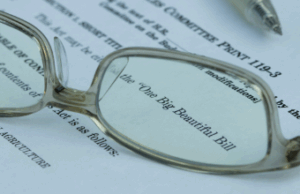

These ideas are part of the Tax Relief for American Families and Workers Act of 2024—more commonly known as the One Big Beautiful Bill (OBBB) Act—which introduces new opportunities for employees to reduce their federal taxable income on certain overtime and tip earnings.

These changes come with new responsibilities. Employers will need to adjust how they track qualifying wages and prepare for updated W-2 reporting requirements starting in 2026.

Here’s what the law covers, what “no tax” really means for you, and how small businesses can stay compliant as the IRS rolls out the details.

“No Tax on Overtime and Tips” Explained

The OBBB Act does not eliminate all taxes on overtime or tips. Instead, it allows eligible workers to deduct certain amounts from federal income tax. These wages are still subject to Social Security and Medicare taxes (FICA) and applicable state and local income taxes, if any. (Source: IRS, Publication 15 – Circular E, Section 6, Tips)

Think of it as a federal income tax discount, not a blanket tax exemption.

Eligibility Rules

To claim these deductions, employees must:

- Work in a qualifying occupation (the IRS will publish the official list)

- Receive qualified tips or qualified overtime

- Meet IRS documentation requirements on their tax return

Limits on Deductions

While final regulations are still in process, the law generally limits deductions to qualified tips up to $2,500 per year and overtime pay up to 100 hours per year (only the overtime premium portion).

The IRS may refine or clarify these limits as new guidance is released. Stay up to date with tax changes from the One, Big, Beautiful Bill on IRS.gov.

What Counts as “Qualified Tips”?

For federal tax purposes, qualified tips include tips employees receive voluntarily, tips employees report to you using Form 4070 or your payroll system, and digital tips (credit card, app-based, online orders).

“Non-tip wages” that don’t qualify include service charges, mandatory gratuities (aka “auto-gratuities”), and any amounts the employer controls or redistributes.

These follow the rules outlined in IRS Topic No. 761: Tips — Withholding and Reporting (IRS.gov).

What Employees Need to Know

Most employees care most about one thing: how do I get the tax break? Here’s the simplest way to explain it.

Employees must qualify based on occupation: The IRS will publish a final occupation list before the 2025 tax season (Source: IRS.gov). Early drafts include hospitality, retail, food services, and other tip-heavy industries (Source: GovInfo.gov). Starting in 2026, employees will use the new W-2 fields to claim deductions on their federal return.

Documentation matters: The IRS has emphasized that unreported or improperly reported tips are not deductible. Employees must keep tip records, pay stubs showing overtime hours and overtime premium pay, and a copy of their W-2 showing the new reporting boxes.

The deduction lowers taxable income, not gross pay: Employees may think they’re “getting paid more.” In reality, they keep more of their paycheck because they’re taxed on fewer federal income tax dollars.

Consider sharing the IRS Interactive Tax Assistant tool with employees to determine if their tip income is taxable.

What Employers Need to Do Now

While employees get the tax break, employers carry the reporting responsibility. Here’s what changes for you:

Payroll systems must track qualified wages separately: You’ll need distinct reporting categories for qualified tips and overtime, non-qualified tips, and regular overtime. This ensures accurate W-2 reporting later.

You’ll need to include new wage fields on W-2s: Starting with 2026 forms, the IRS will add fields for: total qualified tip income, total qualified overtime pay, and the amount excluded from federal income tax. Check out the IRS website, to see early release drafts of the 2026 Form W-2, Wage and Tax Statement, and the 2026 Form W-2c, Corrected Wage and Tax Statement.

You must maintain accurate tip reporting practices: This includes:

- Ensuring employees report tips daily or through Point of Sale (POS) integrations

- Tracking digital tips correctly

- Avoiding miscoding service charges as tips

The enforcement guidance mirrors existing tip-reporting rules found in IRS Publication 531: Reporting Tip Income

Communication will matter

You’ll likely need to update onboarding materials, notify employees of new W-2 boxes, and explain why federal taxable wages may look different than gross wages. Clear communication reduces confusion during tax season.

IRS Timeline and Ongoing Updates

Because the IRS is still implementing the new law, here’s a realistic timeline of what to expect:

2025 Tax Year

- Overtime and tip deductions become available for employees

- Employers must begin tracking qualifying wages

2026 Filing Season

- New fields appear on Form W-2 and Form 1099

- Employers must report qualifying wage amounts accurately

IRS may update:

- Definitions of “qualifying occupations”

- Tip reporting requirements

- Documentation rules

Employers should continue monitoring IRS.gov for updates, particularly the W-2 Instructions page and Publication 15 updates.

Looking Ahead With Commonwealth Payroll & HR

While these tax changes won’t fully take effect until 2026, the preparation starts long before the IRS updates its forms. And that’s exactly where a trusted payroll partner makes all the difference.

At Commonwealth Payroll & HR, our team stays ahead of new legislation and is available to clarify how changes may impact your business or what adjustments might be needed. If you want expert insight paired with truly personalized service, let’s talk. We offer the guidance and payroll platform that keep you compliant, confident, and prepared for what’s next.

TOP

TOP